HO Annex Building Inaugurated at Nattika

On Aug 11, Manappuram Finance Ltd, started functioning from a new office at Nattika. Hon’ble MD & CEO Mr. V P Nandakumar inaugurated the HO Annex building along with Mrs Sushama Nandakumar.

On Aug 11, Manappuram Finance Ltd, started functioning from a new office at Nattika. Hon’ble MD & CEO Mr. V P Nandakumar inaugurated the HO Annex building along with Mrs Sushama Nandakumar.

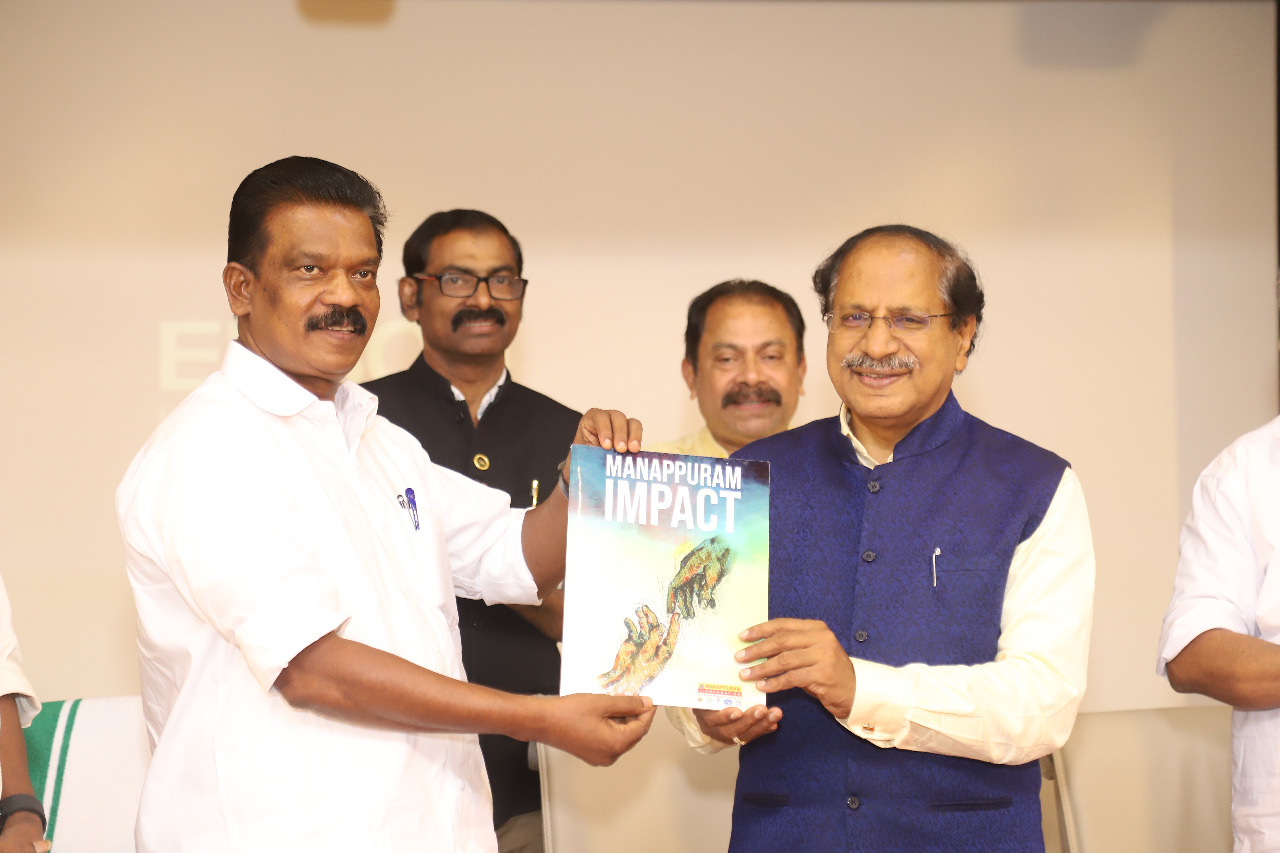

On 23rd September 2022, Friday, Hon’ble Minister for SC/ST Welfare and Parliamentary Affairs K Radhakrishnan handed over house keys to 25 homeless families at Sarojini Padhmanabhan Auditoriam, HO Valapad. Mr. V P Nandakumar, the MD & CEO of Manappuram Finance as well as the Managing Trustee of Manappuram Foundation, presided over the function. The houses were built as part of the Sneha Bhavanam initiative launched by Manappuram Foundation, the CSR body of Manappuram Finance Limited.

Manappuram Foundation donated raincoats to civil defence workers attached to the Fire and Rescue station at Nattika on 1st Oct 2022.

At the Kaalikutty Smaraka Samskarika Nilayam, Edathiruthy Gramapanchayath, education kits were distributed to 126 deserving students from 18 wards on October 12. This was part of an initiative called Aksharamuttathu Thanalayi by the Manappuram Foundation.

Koduvally MLA Mr M.K. Muneer handing over the cheque from Manappuram Foundation to Mr Swaroop A C to help him get a prosthetic leg on October 20, 2022 at Kozhikode. Also present were Mr. George De Das, CEO, Manappuram Foundation and Silpa Tresa Sebastian, Chief Manager, Manappuram Foundation.

On October 24, Manappuram Foundation kickstarted a project to provide medical treatment to 50 liver patients from Thrissur and Ernakulam districts. It was inaugurated by Mr K Rajan, Minister for Land Revenue.

India is the second-largest consumer of gold in the world, and over the years Indians' enthusiasm for gold has never decreased. The World Gold Council is projected to stay idle with indigenous citizens for about 22,000 tonnes of gold. This has encouraged the government, banks, and NBFCs to actively push gold loans in India and transform them into financial assets.

It was on New Year’s day of January 1, 2013 that the Manappuram Foundation started “Pakalveedu” (Day Centre) at Thalikulam in association with a local NGO, Thalikkulam Vikas Trust. What the Pakalveedu offers is daylong fellowship to the elderly people living in and around Thalikkulam. The beneficiaries are senior citizens over 65 years of age. The centre works from 10 a.m. to 5 p.m., Monday to Friday. Their day is well spent with activities aimed at their social and intellectual nourishment, as also taking care of their physical health.

Everyone says the customer is important, but only a few companies invest the time, effort and financial resources to do what needs to be done to build a more loyal customer base.

By V.P. Nandakumar

On November 6, 2016, Manappuram Finance Ltd. celebrated 20 years of listing on the BSE. Mr. V.P. Nandakumar, MD & CEO, looks back at the triumphs and tribulations of those early days in the history of the company.